Trading Breakout Stocks

Define Breakout

A breakout happens when an asset price moves out of defined support and resistance areas with increased volume or momentum. Stocks breakouts are considered a vast source of opportunity or risk in the market. When a breakout occurs, it may be the beginning of a strong trend. Breakouts can offer huge opportunities for massive profits because they allow traders to ride out a new trend from its very beginning.

How to Find Breakout Stocks

So, how does the volume affect stock price? Like in any other market, stock prices are influenced by forces of demand and supply. Breakouts are generally preceded by a period of low volatility, where the price is contained by resistance, support, or both. This means that there is indecision among buyers and sellers.

Breakouts then occur when there is a change in the supply and demand of a stock. For instance, a stock will break a resistance level when there are more buyers than sellers at that particular time, whereas a support level will be broken when sellers outweigh buyers.

There are generally two types of breakouts: continuation breakouts and reversal breakouts. Continuation breakouts happen when a stock has been trending in a particular direction and then enters a period of consolidation. This can be a result of profit-taking or the exit of market participants.

After that period of consolidation, the stock will break out and continue in the direction of the previous trend. On the other hand, a reversal happens when a stock has been trending in one direction and then enters a period of consolidation. However, the price will break out in the opposite direction after consolidating.

Therefore, the key to determining a breakout stock is a market that is in a period of consolidation. It is a stock characterized by low volatility and will be contained by defined support and resistance levels. It can be contained in channels or even candlestick patterns, such as triangles, flags and wedges.

It is crucial to qualify the support and resistance levels. A strong and lucrative breakout will happen when strong support or resistance level has been breached. A strong support or resistance level has been tested numerous times and remained valid for a more extended period.

Most Common Breakout Patterns

Here are some of the most stock breakout patterns that can be traded in the market:

Bollinger Bands Breakout

Bollinger Bands is one of the best indicators for breakout trading. It is used as a volatility channel when tracking and timing stock breakouts. A Bollinger Bands Squeeze will highlight periods of low volatility – this is when upper and lower bands of the indicator converge, especially after a period of prolonged trends. The indicator does not provide any price breakout directional cues. Still, the return of high volatility in the market is denoted by the divergence of the upper and lower bands of the indicator.

A bullish breakout occurs when the upper band is breached, whereas a bearish breakout happens when the lower band is breached. When trading Bollinger Bands stock breakouts, the stop loss is placed above or below the opposite band of the breakout direction. For instance, in the case of a bullish breakout where the upper band is breached, the stop loss is placed below the lower band.

Cup and Handle Breakout

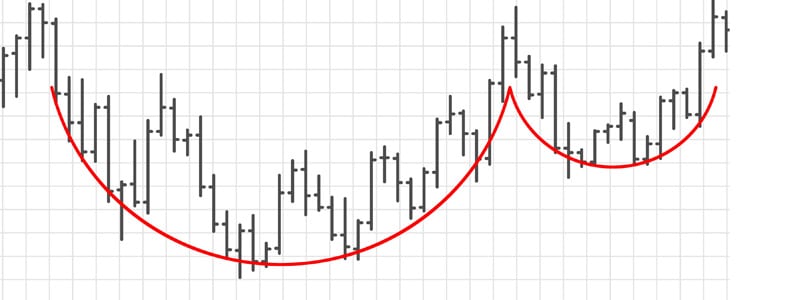

The cup and handle pattern is very popular for trading stock breakouts. There are two parts for the formation of this pattern: a cup and handle. The cup forms when the price falls from a high and then recovers to almost the same level. It forms a bowl-like shape on the chart. After the formation of the cup, the price then starts consolidating sideways, thus creating the handle.

The handle must be smaller than the cup, and ideally, it should not drop below the bottom half of the cup. The breakout occurs when the handle’s resistance is breached with high volume. When trading the cup and handle stock breakout strategy, the stop loss is placed below the handle support, whereas the profit target is the height of the cup.

Trading Breakout Stocks

After identifying a potential breakout stock, here are the steps of trading it:

- Wait for the breakout to happen – After highlighting your support and resistance levels, watch out for when they will be breached. For stocks trading, it is essential to exercise patience and wait until around market close on the day that support and resistance have been breached. In this way, you can be certain that the breakout is valid, and it was not just a false signal.

- Set a reasonable objective – Trends do not last forever after a price breakout. It is therefore vital to set reasonable objectives when trading stock breakouts. Various principles of technical analysis can do this. You can set an objective depending on the average price movement that a stock is historically known to make over a certain period. When trading breakout chart patterns, you can also use defined principles to set optimal targets. For instance, when trading the cup and handle pattern, an optimal objective is the height of the cup.

- Allow for a re-test – Breakouts are as lucrative as they are risky. The most significant source of risk is a false breakout. It is important to wait for a re-test of the broken support or resistance level after a breakout. After a breakout, the price tends to retest the broken level. For instance, if a support level has been broken, it will now turn into a resistance level for the new or continuing downtrend. The patience to wait for a re-test of a support or resistance level can help find quality entry points and filter out false breakouts.

- Know when a pattern has failed – False breakouts are the biggest source of risk in this strategy. As such, identifying false breakouts can limit your overall risk exposure. A breakout pattern fails when the initial support and resistance levels again contain the price. For instance, the breakout becomes invalid if a resistance level is broken, but the price falls below it. In such a scenario, it is prudent to cut your losses.

- Exit towards market close – When exiting a losing trade, it is wise to do so towards market close. This is because, during the market opening, it might be difficult to ascertain that prevailing prices will hold during the active trading hours. But towards the market close, the prices probably represent the consensus of market participants.

- Exit when your objective is achieved – When your trade is winning, it is important to hold out until your target is achieved. You can have a time-based or price-based target. A time target will prompt you to exit after a specific duration of time, whereas a price-based target can be determined by the average movement of the stock or chart patterns.

Trade Breakout Stocks with AvaTrade

Track and trade breakout stocks with AvaTrade. Here is why:

- International Broker – AvaTrade is a reputable global broker that has been licensed and authorized in multiple jurisdictions around the world.

- Favourable Trading Conditions – Trade breakout stocks with low spreads, unrestricted short selling, transparent prices, and fast trade execution.

- Effective Tools and Resources – Trade breakout stocks on advanced AvaTrade platforms that feature comprehensive charting tools and handy resources such as AvaProtect, AvaSocial, and Trading Central.

- Excellent Support – Trade with maximum support. Contact our friendly, professional, and highly responsive customer support for any assistance.

** Disclaimer – While due research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

See a trading opportunity? Open an account now!

FAQ

- What’s the definition of a breakout?

A breakout occurs when a stock’s price moves above a resistance level or below a support level with increasing volume or momentum.

- How do I find stocks ready to breakout?

A potential breakout stock is experiencing low volatility and features low price movement. Such a stock is likely to break out when high volatility returns to the market.

- Is a stock breakout good?

A stock breakout could be a lucrative opportunity because it gives investors a chance to maximize profits by riding a new trend from its early beginnings.