Trade FX & Options Visualty

Streaming Prices for 40+ currency Pairs & Gold

Trade spot FX from custom charts

Implement any of 13 top option strategies

Measure & Manage risk

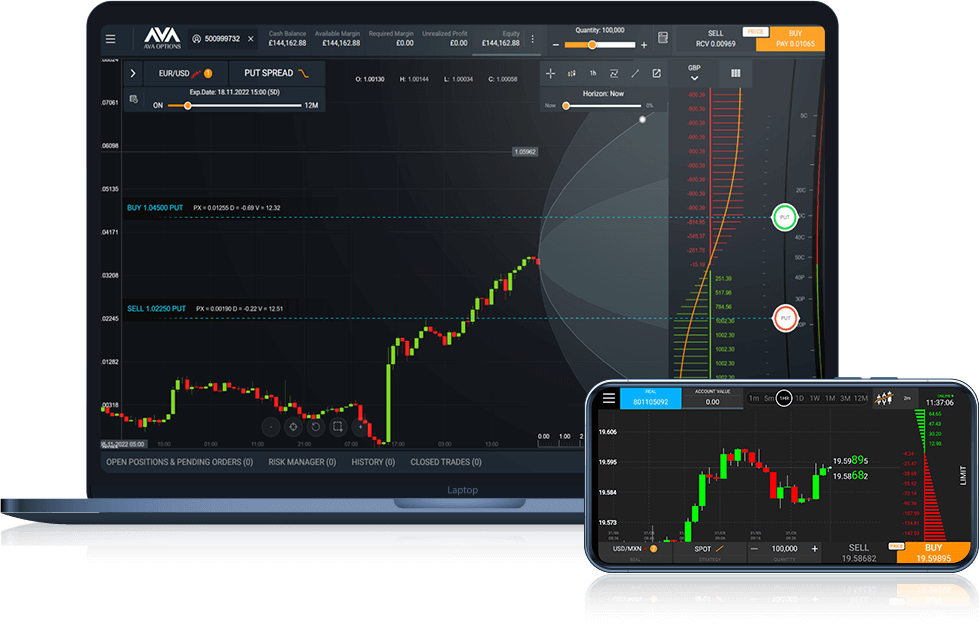

Trade FX & Options Visuality

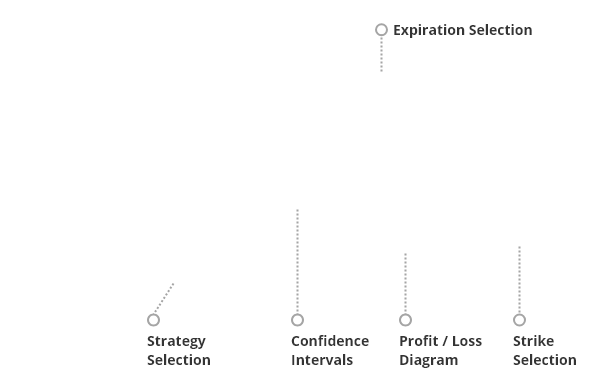

Structure any FX or Option trade with our unique interactive page

The historical chart shows you the past, and Confidence Interval shows you where the market may be heading

Profit/Loss Chart shows your risk and reward, and updates live

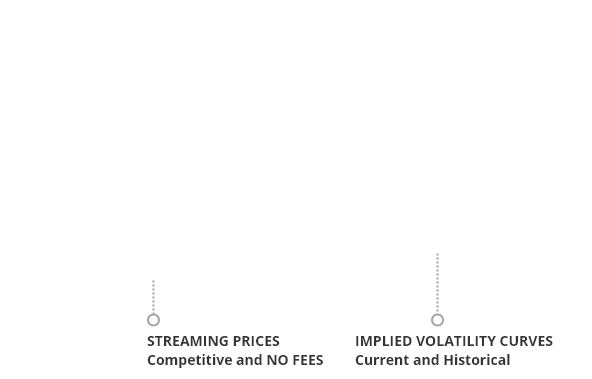

Streaming Prices for 40+ currency Pairs & Gold

Custom Market Watch pages load quickly

Implied volatility curves give you the full market picture

Visualise current and historical implied volatility, and realised volatility

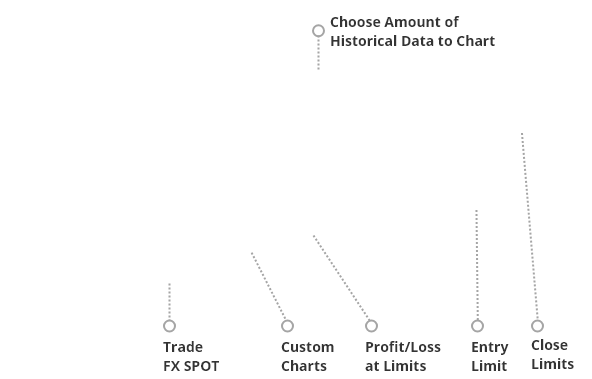

Trade spot FX from custom charts

Set entry and closing limits directly from the chart – get a clearer picture

See instantly how limit orders impact trade risk and profitability

Interactive sliders allow you to set entry limit or stop, and closing Take Profit and/or Stop Loss orders

Implement any of 13 top option strategies

Trade Spot, Calls, Puts, and Combination strategies from a clear menu

Spreads are automatically reduced for combination strategies, like Spreads and Risk Reversals

New Integrated Strategy Guide helps you to structure your trade right

Measure& Manage risk

Bar charts show net exposure by currency pair and by single currency

Special pages offer summary of portfolio risk, including Delta, Vega, and Theta

Open Positions page shows each trade’s risk measures, with full sort and filter capabilities

Forex Options and beyond

Create the optimal portfolio - choose from over 40 currency pairs and any combination of CALL and PUT options in one single account. Execute Straddles, Strangles, Risk Reversals, Spreads, and other Strategies, with just one click.

Get the bigger picture

AvaOptions gives you total control over your portfolio, letting you balance risk and reward, to match your overall market view.

Take a view, hedge or trade to generate income

BUY options to hedge risk or take a view, SELL options to generate income – it’s easy with our intuitive trading platform. Expirations available on business days – choose from overnight, to one-year expiration, at any strike price you set.

Risk management tools

AvaOptions includes a wide selection of professional risk management tools, portfolio simulations, and much more. Powerful desktop and mobile platforms can empower your trades.

Flexible orders mean absolute controls

Trade CALLS and PUTS with stop and limit orders, which can be triggered by a pre-determined premium level, mean added control over trade entry and exit. Trade strategies for improved pricing efficiency.

Built with money managers in mind

We offer full money management functionality to let you trade multiple accounts with one single ticket.

We see that you are

Already an existing client.

As a valued client,

Here is a link to the e-book

Thank You! Our insightful Online

Trading eBook is

already in your inbox.

Use it wisely and start trading!

Thank You! Our insightful Online

Trading eBook is

already in your inbox.

Use it wisely and start trading!

Oops…

Something went wrong,

please try again later.